Insights and Opportunities

How to use these insights

- As you read through each insight, take the time to understand the nuances of Lower-Income Families’ day-to-day considerations, and try to understand their perspective. The insights are complex, but worth exploring!

- Keep an eye out for opportunities you can pursue —either as an individual or as part of an organisation — to address Lower-Income Families’ unmet needs.

Key Themes

Insight

Area of Opportunity

1. Fostering Trust and Collective Ownership

Key Themes

Insight

Area of Opportunity

- Adopt a strengths-based approach to enable trust-building

- Build collective ownership to support Lower-Income Families

Key Themes

2. Prioritising Education

Insight

Area of Opportunity

- Encourage lower-income parents to value early childhood education for better upstream intervention success

Key Themes

Insight

- Lower-Income Families want flexibility, security, and stability in their employment

- Lower-income individuals need relevant upskilling and job-training opportunities that can lead them to higher wages

- Lower-Income Families would like more guidance and support structures to meet their long-term financial goals

Area of Opportunity

- Explore alternative models of work that meet the needs of lower-income workers

- Transform the upskilling and job-training experience to increase social mobility

- Build a financial support system that guides Lower-Income Families to achieve long-term goals

Key Themes

Insight

Area of Opportunity

- Increase accessibility to home ownership or alternatives that meet their home needs

- Home

- Finance

- Education

- Well-Being

- Social Participation

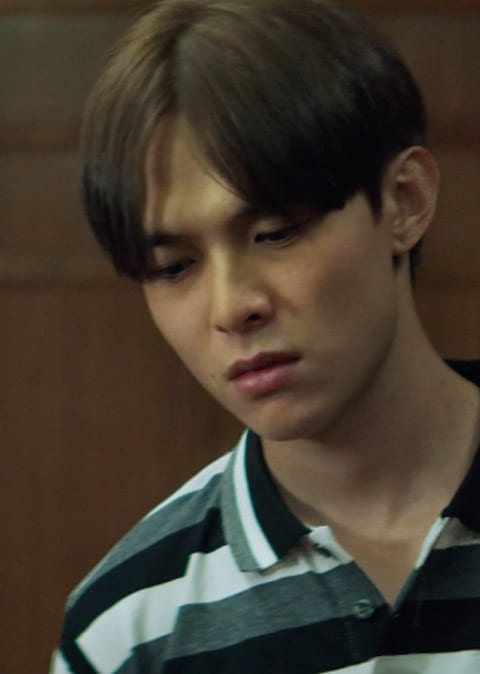

Insight #1: Lower-Income Families should be seen for their strengths and not as a “case number” or “issue” to be solved

Background:

Trying to address underlying issues for Lower-Income Families might lead others to inadvertently view these families as a “problem to be solved” or a mere case number. As a result, these families might feel disempowered or believe they are a burden.

But Lower-Income Families are whole people with dreams and aspirations. They are valued assets of our community and should be treated as such. When interacting with Lower-Income Families, we should help them focus on their strengths to build towards a better future.

There are also many touching cases of social workers who have gone above and beyond to journey with Lower-Income Families. But these workers also risk burning out, especially when they have a high casework load. With a high number of families to cover, these workers may struggle to achieve depth with each client as their time and resources are stretched.

Area of opportunity:

Adopt a strengths-based approach to enable trust-building

Strengths-based approach to integrate dignity and hope throughout their journey

Redesign the process of receiving help to start from a point of trust and reassurance

Possible ideas:

Integrate the following key principles into our processes for providing assistance to families:

- Preserve dignity: Allow families to feel valued and empowered, enabling them to be self-reliant yet open to receive support when needed.

- Build on strengths: Leverage their natural assets to build sustainable solutions.

- Reinforce hope: Encourage them to achieve and celebrate small victories.

Insight #2: Lower-Income Families’ needs should be addressed using a holistic approach

Background:

While many programmes directly target Lower-Income Families, some needs are best met through the power of communities and collective networks. Lower-Income Families need trusted advocates who endeavour to understand their complex challenges, and can journey with them in the long-term and not just meet their immediate needs.

Area of opportunity:

Build collective ownership to support Lower-Income Families

Change perceptions: Influence society’s perception of Lower-Income Families: value them for their strengths, encouraging higher inclusivity and integration

Activate co-creation: Encourage different communities to share resources and co-create solutions with Lower-Income Families

Possible ideas:

- Promote understanding and empathy among the wider society by:

- Highlighting the strengths of lower-income groups

- Advocating that everyone has a part to play in creating a more inclusive society

- Different communities (e.g., local businesses, employers, schools, neighbours, etc.) can further define their unique role in supporting Lower-Income Families. Working with Lower-Income Families can lead us to addressing missing gaps in the system.

- Embrace different interpretations of a trusted advocate

- Families and individuals define “trusted advocate” differently — it can be a social worker or someone from their own community, like a neighbour.

Initiative Spotlight

ComLink (Community Link) embodies an approach that focuses on long-term social empowerment for families with children living in rental housing. The Ministry of Social and Family Development works with a network of corporates, community partners, and volunteers in providing comprehensive, coordinated, and convenient support for these families. It is a nation-wide initiative that is expected to support around 14,000 families across Singapore.

What you can do next:

Insight #3: Lower-income parents may not value or have the resources to prioritise early childhood education

Background:

Parents of Lower-Income Families may not view pre-school as necessary, particularly if they grew up in a household where preschool was considered a luxury rather than a norm. As a result, they may see it as a commitment that requires extra time, money, and logistical resources that they can’t spare. These concerns may overshadow their view of the long-term benefits of early childhood development.

Parents may also doubt and distrust preschool staff. They may feel more at ease leaving their children in the hands of someone they know, such as grandparents or neighbours.

Area of opportunity:

Encourage lower-income parents to value early childhood education for better upstream intervention success

Increase awareness: Better communicate the value of early childhood education to lower-income parents by leveraging on existing community influencers

Possible ideas:

- Utilise communities for outreach — neighbourhoods they live in, schools (for parents who have younger children)

- Share available resources that facilitate enrolment and other early childhood education opportunities to get lower-income parents’ buy-in

Initiative Spotlight

The government provides Basic Child Care Subsidy to families with children enrolled in licensed childcare facilities. Lower-income parents can also apply for the Additional Child Care Subsidy that goes up to $710 for infant care and up to $467 for childcare.

KidSTART Singapore is a non-profit organisation that specialises in supporting families in early childhood development. The team works to empower Lower-Income Families in building strong foundations for their children under 6 years old, to give them a good start in life.

What you can do next:

Insight #4: Lower-Income Families want flexibility, security, and stability in their employment

Background:

Area of opportunity:

Explore alternative models of work that meet the needs of lower-income workers

Job creation: Partner with employers to create dignified and secure job opportunities that provide flexible work and pay arrangements

Increase awareness of needs: Educate employers on the needs of lower-income workers, to better engage them for work

Possible ideas:

- Encourage employers to value lower-income individuals as unique assets

- Empathise with lower-income breadwinners on their varied needs and bandwidth

- Redesign job options to reflect the needs of lower-income individuals

Initiative Spotlight

Skillseed’s Resilience Trails programme engages individuals from under-resourced communities as Community Guides. The guides are able to use their unique strengths to co-create and co-lead learning journeys in their own neighbourhoods. Skillseed prioritises the Guides’ schedules so they can have flexible employment, and pays Guides within 14 working days of their Trails so as to expedite their cash flow. Guides are also paid throughout the orientation and co-creation process so as to expand their bandwidth for committing to the programme, and are protected under Skillseed’s terms and conditions in the event of client cancellations.

What you can do next:

Insight #5: Lower-income individuals need relevant upskilling and job-training opportunities that can lead them to higher wages

Background:

Lower-income workers may be hesitant to upskill due to their negative experiences in the education system. They may not see the value of upskilling when qualifications may not be recognised by employers and does not guarantee a higher-paying job.

Often, upskilling also means sacrificing current income or valuable rest time. It incurs associated costs like transportation, training fees, and childcare arrangements. Switching to a higher-paying job could also mean losing subsidies that Lower-Income Families depend on. These considerations can deter Lower-Income workers, whose resources are already tight, from upskilling.

Language is also a barrier for Lower-Income workers who don’t speak English as their first language. Lessons that use overly specialised language and technical jargon may be challenging to understand.

Area of opportunity:

Transform the upskilling and job-training experience to increase social mobility

Redesign programmes: Rethink current upskilling programmes to address the needs of Lower-Income Families

Sense of ownership: Encourage lower-income workers overcome their fear of learning and take ownership to upskill themselves

Possible ideas:

- Enable a mindset shift: For lower-income workers to see themselves for their strengths; upskilling is a worthy investment for them to transition to better-paying jobs

- Redesign upskilling and job-training opportunities: As childcare and transportation costs could be an issue for Lower-Income Families, we need to rethink these programmes

Initiative Spotlight

Agape Connecting People’s Transformation program is an eight-day on-site training course to help members of vulnerable communities find employment. Learners are attached to a mentor to help them build resilience and take ownership of their personal development and well-being.

What you can do next:

Insight #6: Lower-Income Families would like more guidance and support structures to meet their long-term financial goals

Background:

Lower-Income Families may have limited mental bandwidth to plan long- term, being preoccupied with meeting their immediate day-to-day needs. They may find it difficult to sustain the journey — from planning, implementing to achieving — as unexpected crises can crop up, demoralising and detracting them from their goals.

A lack of access to reliable information and support networks may also lead to uninformed and less ideal choices.

Area of opportunity:

Build a financial support system that guides families to achieve long-term goals

Encourage small steps: Inspire and empower Lower-Income Families to take small steps towards building long-term financial security

Possible ideas:

- Ramp up financial literacy education for children and start it earlier in schools

- Increase access to genuine and reliable information resources and networks

- Rethink financial plans to allow families to sustain their plans, have control over their savings, and be motivated to save more

- Build an ecosystem of support that provides greater scaffolding and celebrates small wins

Initiative Spotlight

Local banks like POSB and Standard Chartered offer a kids savings account with no minimum balance or initial deposit, allowing Lower-Income Families the flexibility to save.

Banks like Maybank and POSB are active in running financial literacy programmes for both children and adults. Maybank has been sponsoring matched savings programmes for more than a decade with the Community Development Councils (CDCs) where Lower-Income Families can enjoy dollar-for-dollar matching on their savings and are incentivised for attending financial literacy workshops.

What you can do next:

Insight #7: Lower-Income Families need alternative pathways to create a safe and stable home environment

Background:

- Lack of capital (CPF, renovation costs and furniture etc.)

- Loss of existing social and community support in current residential area

- Additional complexity of planning for new child-care arrangements

Area of opportunity:

Increase accessibility to home ownership or alternatives that meet their home needs

Reduce costs for Lower-Income Families looking to purchase a home in whichever stage they are in

Neighbourhood partnerships to optimise and create alternative spaces for Lower-Income Families to conduct their day-to-day activities

Possible ideas:

- Explore partnerships and collaborations to reduce costs for families moving into purchased homes. Even though moving into a new home can bring security and stability, families may incur high costs as well

- Offer alternative solutions for families who still live in rental flats. As purchasing a home is a journey that requires time and money, we should ensure their current homes meet their needs, or offer alternative third spaces for these families

Initiative Spotlight

The Housing Development Board (HDB) has a Fresh Start Housing Scheme by HDB. It helps families purchase a 2-room Flexi flat or 3-room flat, specifically those with young children who have received one housing subsidy previously, and who are currently living in public rental flats.

Keystart is a home-ownership program by South Central Community Family Service Centre for families living in rental flats with school-going or younger children. The program integrates guidance and financial support to enable families to realise their home ownership aspirations. It also funds cash for shortfalls, basic facilities, and unexpected crises.

HDB’s new Single Room Shared Facilities pilot scheme, while for lower-income singles, highlights the possibility of new living options for lower-income groups.

What you can do next:

To find out more about the Lower-Income Families Colabs Executive Summary, share input, or discover more ways to help, email us at [email protected].

To download the Lower-Income Families Executive Summary, click here.

- Ministry of Manpower, Labour Force in Singapore 2022